The Customer Radar report has exposed the main challenges as unprecedented geopolitical disruption coupled with complex customs and environmental regulations, in-house skills shortages and the impact of AI.

The qualitative interview survey, which features insights from 33 major logistics service providers (LSP) and goods owners (GO), reveals several key trends and challenges for international trade.

The firms surveyed included global freight forwarders and multinational manufacturers of commercial vehicles, consumer goods, retail and FMCG based in five European countries.

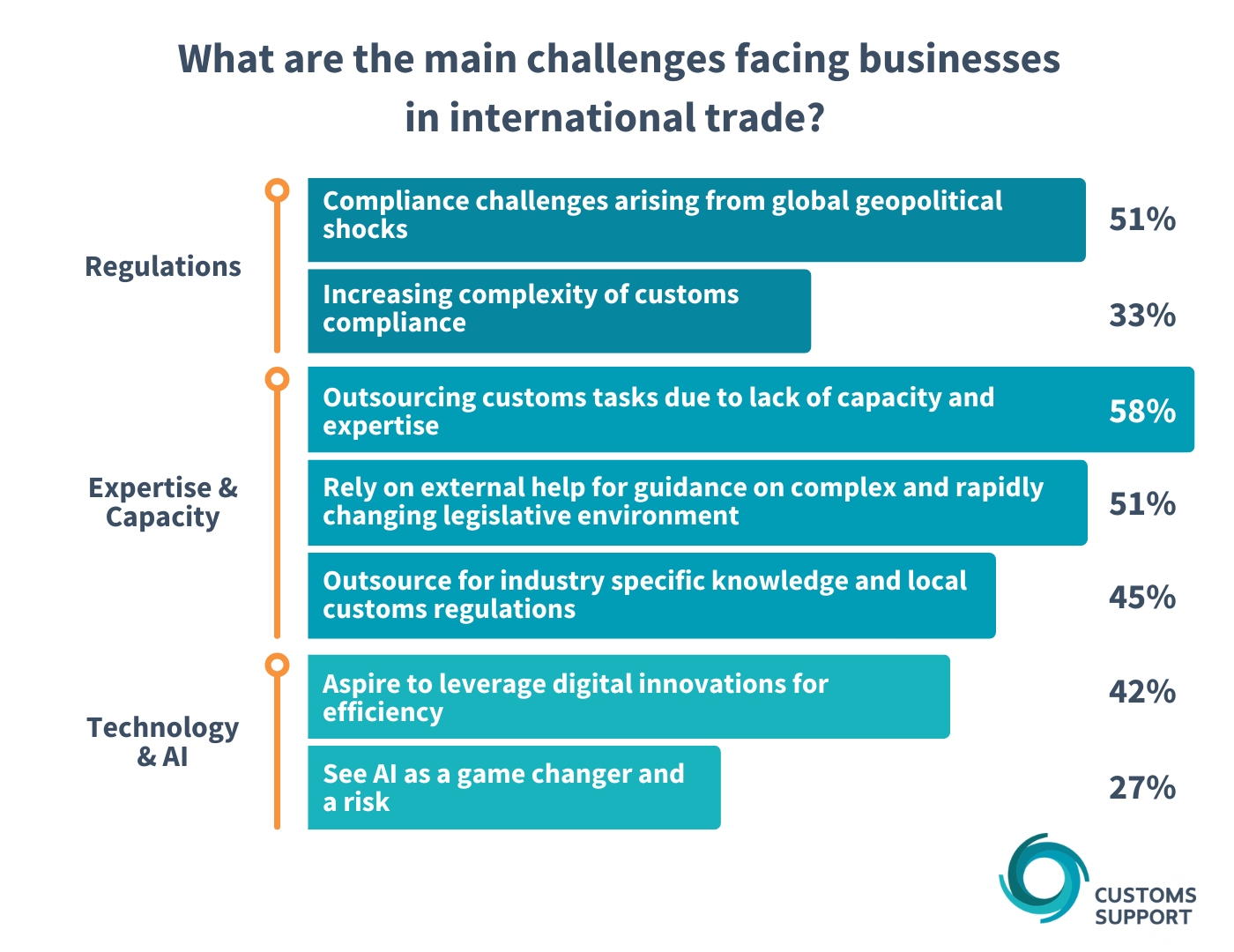

What are the main challenges facing international trade?

Three themes were consistently outlined in the responses – the challenge of complying with geo-political disruptions and the ever-increasing complexity of customs regulations in international trade; a shortage of internal expertise and talent to address these issues and the opportunities and threats posed by automation and AI.

This detailed and far-reaching research has uncovered many insights into the challenges international businesses face when dealing in cross-border trade.

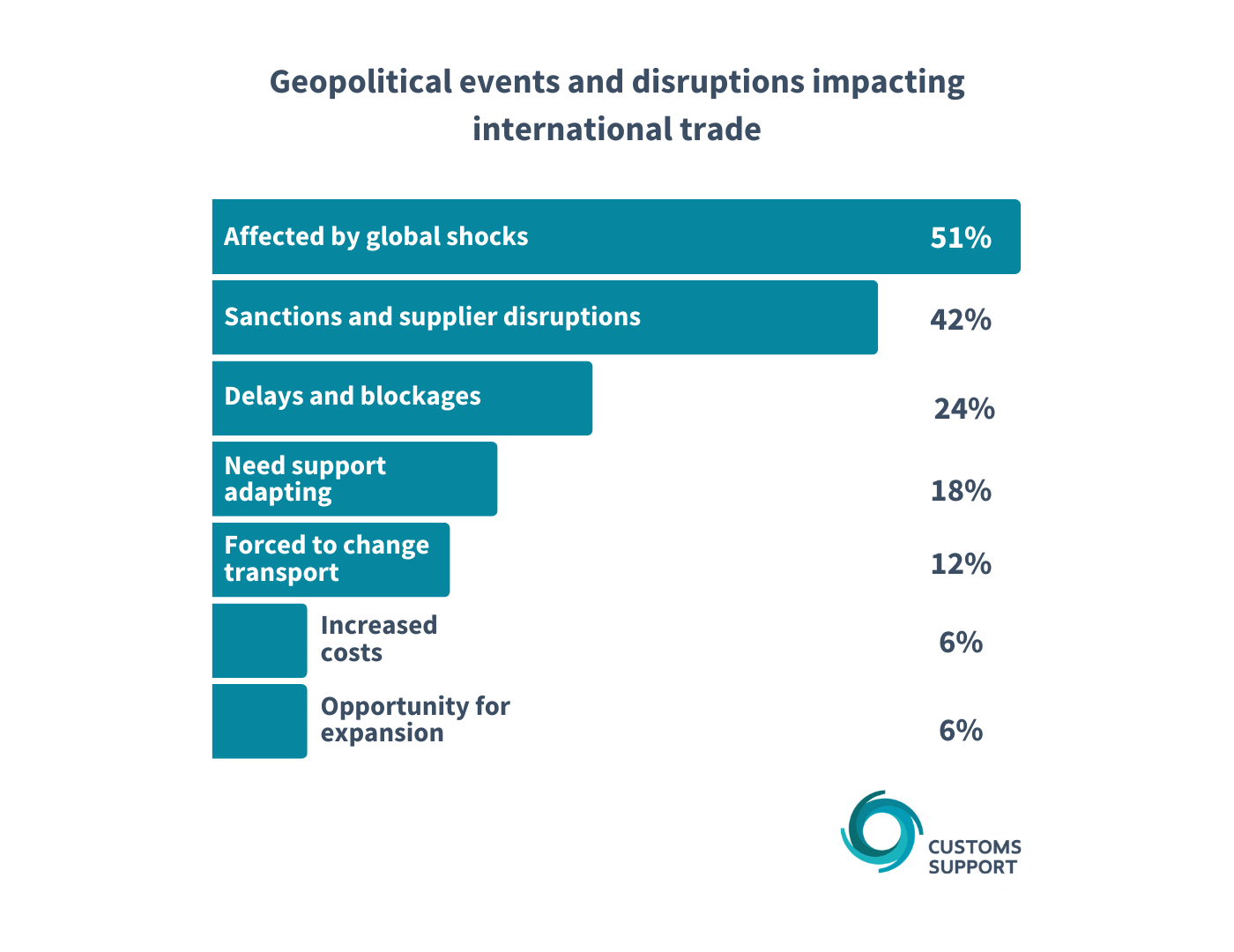

Geopolitics and increasingly complex compliance

Our research shows more than half (51 per cent) of businesses surveyed have been affected by global shocks to their international trade, such as the Suez Canal blockage and the war in Ukraine.

42 percent of companies had to address challenges arising from anti-Russian sanctions, including dealing with increased compliance risks and experiencing higher costs when working with international suppliers.

In addition, nearly half (45 per cent) have needed specialised expertise to ensure compliance with local and international customs regulations and dealing with stricter environmental regulations.

- Affected by global shocks: 51%

More than half of businesses surveyed have been affected by global shocks to their international trade, such as the Suez Canal blockage and the war in Ukraine. - Sanctions and supplier disruptions: 42%

Imposition of sanctions (e.g. against Russia), creates challenges for companies working with international suppliers in terms of high costs and compliance risks. - Delays and blockages: 24%

Geopolitical events, such as the Suez Canal blockage, Russian sanctions and Brexit have caused significant delays and disruptions in supply chains. - Adaptability: 18%

Clients are looking for partners who can help them adapt to sudden geopolitical changes and say adaptability to new disruptions is a challenge to business continuity. - Transport mode: 15%

Geopolitical events often force companies to change their modes of transport (e.g. shifting from rail to air) due to political instability, creating logistical and customs challenges. - Costs: 6%

Geopolitical events lead to increased costs, particularly when it comes to re-routing shipments or using alternative transport methods. Managing these costs is a growing concern. - Expansion: 6%

For some LSPs, geopolitical trends give opportunity to develop new service offerings to help their clients navigate their challenges.

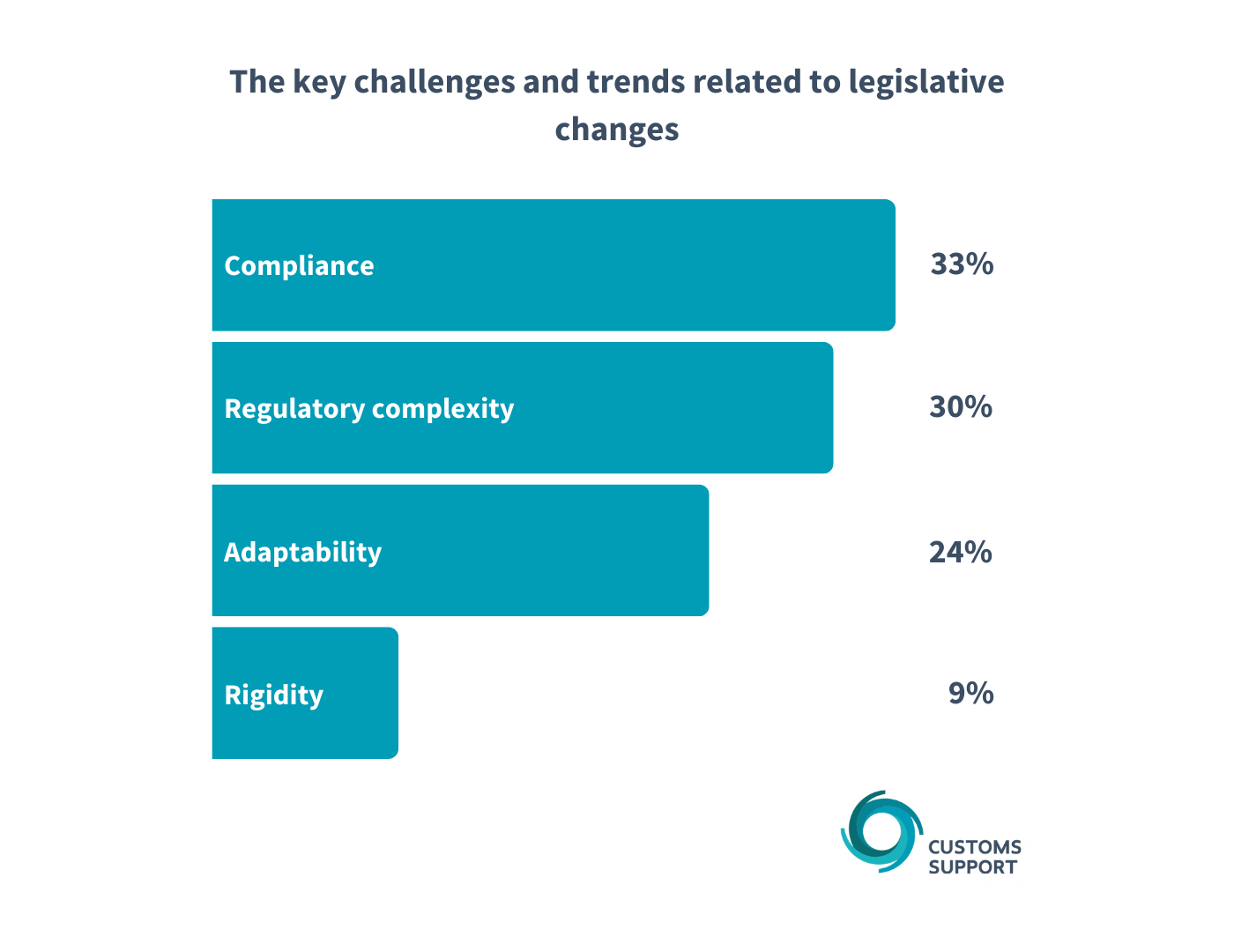

Legislative changes

The key challenges and trends related to legislative changes include:

- Compliance: 33%

Compliance with customs regulations is a top priority for clients. Many have expressed concern about the complexity and consequences of failing to comply, resulting in severe penalties. - Regulatory complexity: 30%

The complexity of customs regulations requires specialised expertise and presents a significant challenge for companies, especially interpreting legislations. - Fast evolving / adaptability: 24%

Customs regulations are constantly changing. Keeping up with these changes requires flexibility and a proactive approach to ensure compliance. - Rigidity: 9%

Some clients have expressed frustration with the increased rigidity of regulations and authorities, particularly when these regulations are applied inconsistently across regions or ports.

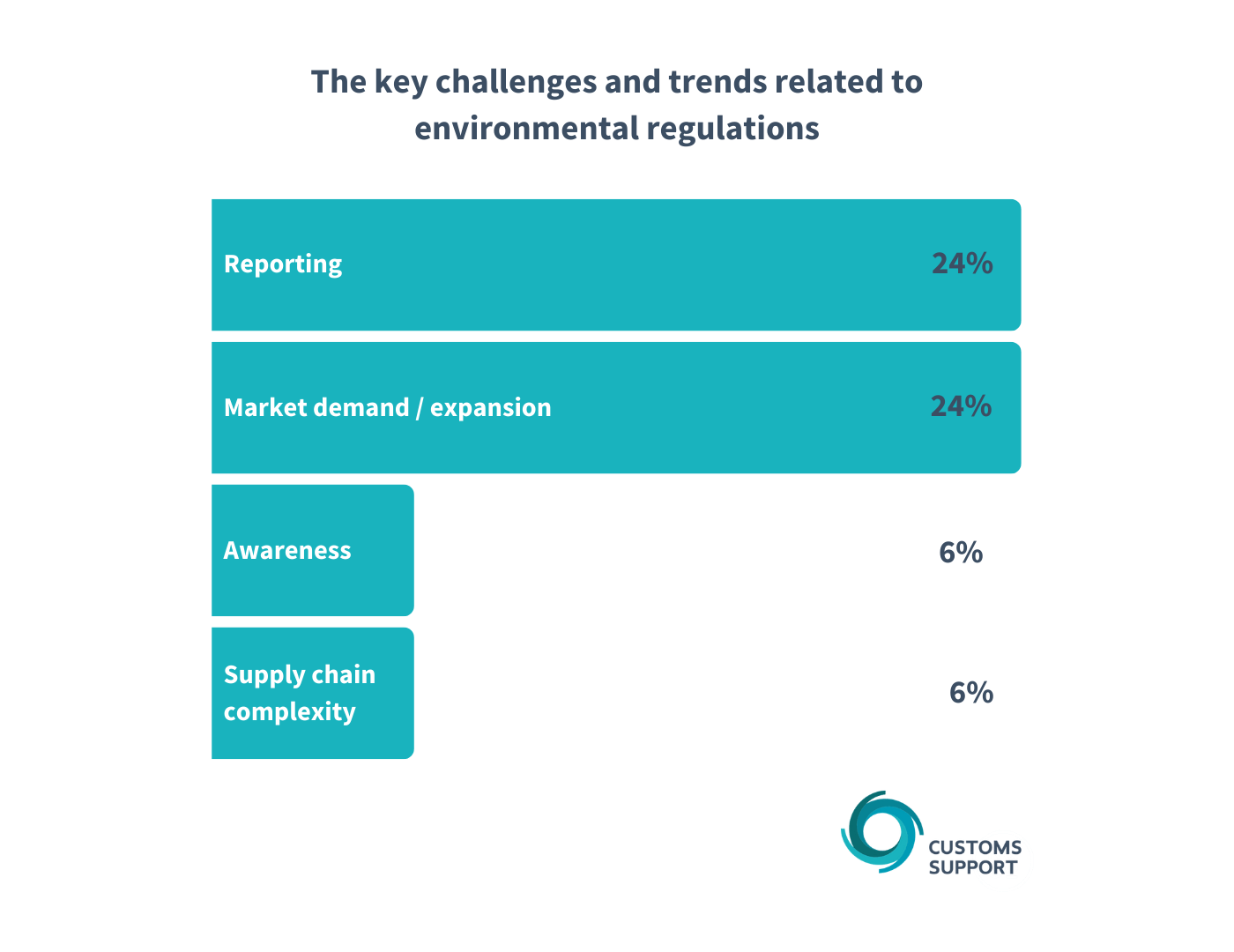

Environmental regulations challenges

The key challenges and trends related to environmental regulations identified in the report include:

- Reporting: 24%

Environmental regulations are becoming stricter, particularly around emissions reporting. Companies are looking for tools to make reporting easier. - Market demand / expansion: 24%

Growing demand for sustainable goods is prompting GO to adjust supply chains towards renewable resources, while to LSPs this trend posts opportunities for services. - Awareness: 6%

Many clients are still unaware of the full impact that environmental regulations such as CBAM will have on their operations. - Supply chain complexity: 6%

Environmental regulations are adding complexity to supply chains, especially CBAM and deforestation regulations.

Clients are facing heightened compliance risks as customs authorities implement stricter regulations, particularly for sanctions and environmental reporting.

Keeping up with rapid regulatory changes and understanding necessary documentation is increasingly challenging for international business.

Skills shortages lead to increased customs outsourcing

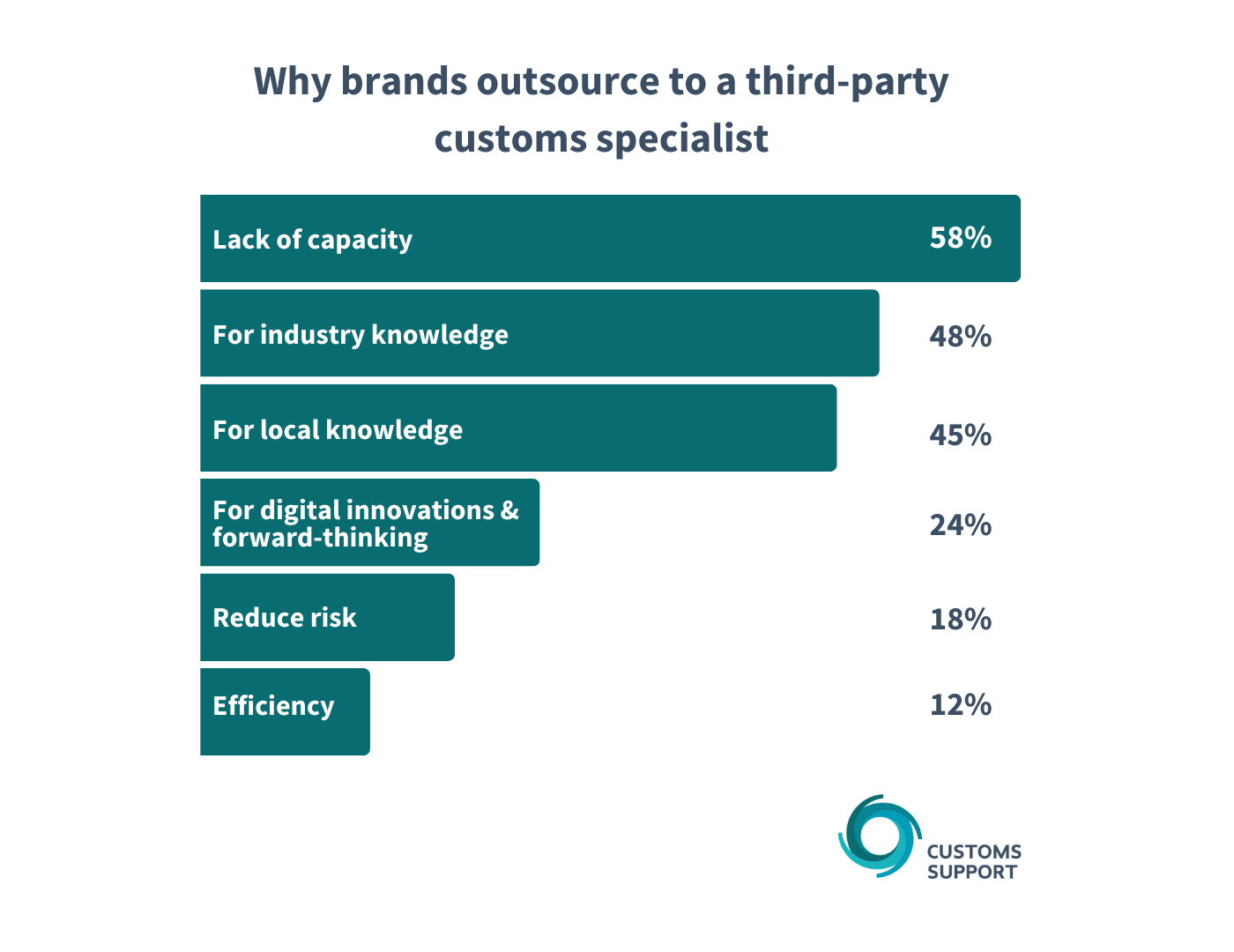

The Customer Radar report examined the trends influencing brands’ decisions to outsource to a third-party customs specialist.

The data reveals a lack of capacity, plus a shortage of internal expertise and talent, is leading to a greater need for customs outsourcing from LSPs and GOs, along with the need for more advanced digital solutions.

Even larger firms with in-house customs teams often lack the expertise needed to address knowledge-driven topics and consider it too much of a risk not to outsource to experts, the report revealed.

Key findings on customs outsourcing due to the lack of internal capacity and specialized expertise

More than half (51 per cent) of respondents said they rely on Customs Support Group for guidance on complex and rapidly changing legislative and geopolitical environments.

- 58 percent of firms choose to outsource customs tasks to help with a lack of capacity, either for dealing with repetitive tasks, processing high volumes of data or seeking specialized expertise.

- 48 percent of LSPs and GOs say in-depth and industry-specific knowledge is important to them, particularly for complex goods, like pet food, for example.

- 45 percent of companies rely on outsourcing to access specialised knowledge, especially while dealing with complex local customs regulations and industry specifics.

- 24 percent look for digital innovations and forward-thinking approach, especially when it comes to adopting new technologies.

- 18 percent outsourced customs to reduce risk of compliance issues.

- 12 percent outsourcing for efficiency reasons.

There is an increasing trend towards outsourcing customs handling to support the work of in-house teams, particularly where complex knowledge and experience is required.

The data shows that in-depth knowledge is valued highly by both LSPs and GOs to ensure operational continuity and risk mitigation. Advanced digital innovations and automation technology is another reason to outsource.

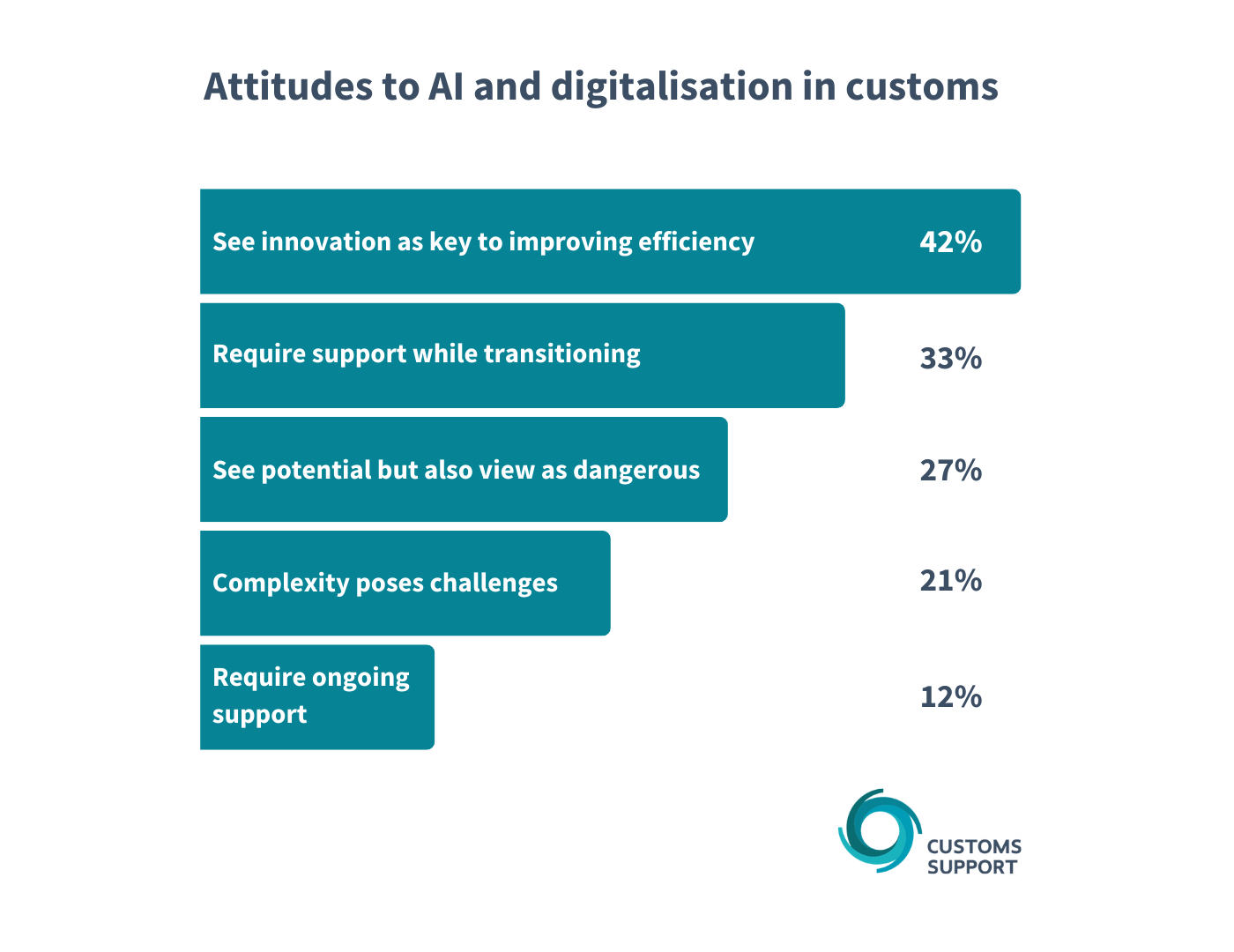

Attitudes to digitalisation and AI in customs

Traditionally seen as a paper-heavy industry prone to errors, customs handling is undergoing a digital transformation, with companies increasingly recognizing the importance of advanced technologies in digitalization and automation.

When asked about AI, the survey revealed that it is seen as both an opportunity and a risk by many businesses when applied to customs compliance, as human oversight and expertise remain crucial to avoid errors and fines.

Increasing digitalization of processes, combined with human expertise, is enabling companies to view customs operations as a data-rich process with value-added potential.

Key findings on digital systems and AI:

42 percent see digital innovations as key to increasing efficiency in data management, especially when it comes to reducing manual work and streamlining customs processes through automation.

33 percent face disruption in operations and require additional support while transitioning to new Enterprise Resource Planning (ERP) and customs systems.

27 percent see potential of AI to reduce manual work, while also viewing it as dangerous.

21 percent say the increasing complexity of digital systems poses a significant challenge.

12 percent need support with navigating the ongoing evolution of digitalisation in customs.

The research tells us that LSPs and GOs view AI as a game-changer, but also a major risk due to the complexity of regulations and their rapidly changing nature.

While AI is seen as a major opportunity to improve customs efficiency, clients are hesitant to automate too much, fearing compliance issues that arise from non-human interventions, alongside the risk of penalties and potential damage to their brands.

Overcoming the challenges of international trade

Our research shows that more companies are now considering customs compliance as a value-added service and see outsourcing to experts as a key part to secure their seamless cross border operations.

A mixture of digital solutions backed up with real-life guidance and support from experts in the field – what we call real intelligence (RI) – helps allay fears of compliance issues arising from increased automation.

We can support the need for real-time track and trace systems, while mitigating the risks from inaccurate client and supplier data driven by the increasing use of AI to support automation.

Our business is built on strong, long-term relationships with flexibility, trust and mutual support at the heart. It is heartening to see this reflected in the responses to our survey.

John Wegman, CEO of Customs Support Group, said:

Ultimately, all three trends can be distilled to a common concern: the fear of non-compliance risks. Such concerns underscore the vital role of customs knowledge and expertise—what we call Real Intelligence—as the key to enhancing AI or navigating the complex and evolving regulatory landscape amidst geopolitical disruptions.

This context explains the growing trend of outsourcing customs handling operations to professionals. As Europe’s leading and largest customs solutions provider, with more than 1,700 industry experts, we are proud to offer our clients peace of mind, ensuring their goods move across borders efficiently and risk-free.